Each year, a well-run organization’s leadership completes a planning and budgeting process. Achievement of the resulting annual business plan is dependent on each organizational unit meeting or exceeding its established goals as part of that plan. This requires that individual leaders take ownership of their part of the plan.

The objective of the Executive Incentive Compensation Program (EICP) is to allow executives who meet or exceed annual performance goals, both financial and non-financial, to participate in the organization’s overall success. The more a given individual or group is responsible for the organization’s success, the greater their share of participation in the rewards. Participation in the program is an important career milestone.

Participants

Executives with significant scope and scale of responsibility for achieving an identifiable portion of the organization’s financial plan and who are, and who are expected to continue to be, employees in good standing are eligible to participate in the program. All staff proposed for inclusion are reviewed and approved by the Core Leadership Group.

Participation is not required. To indicate their desire to participate, each eligible executive submits to the Core Leadership Group, via their manager, a draft of his/her performance goals. The draft is reviewed and edited iteratively with the participant as necessary in order to arrive at agreed-upon, approved, signed, and filed performance goals.

Key staff who join the organization after a quarter of the performance period is completed may participate in the program on a pro-rated basis with the approval of the Core Leadership Group, and with an approved performance plan completed within 21 days of their start.

Award

At the end of the year, participants review and evaluate their performance relative to the plan. Participants who have met both financial and non-financial goals receive their target award. If not quite all goals are met (e.g. 80 – 95 % attainment) then a portion, (e.g., 50%), of the target Incentive Compensation (IC) is awarded. In cases of truly extraordinary performance against financial goals, there may also be the possibility for additional awards to be earned.

Payment

Executive Incentive Compensation awards are paid within two months of closing the organization’s fiscal accounts for the performance period.

Guidance on setting performance goals

The organization’s financial plan includes an operating budget that allocates resources to implement the plan. This planning and budgeting process is simultaneously both top-down and bottom-up so that by the end of the process, each part of the plan is clearly the responsibility of a specific individual or group. To complete the process, upon final approval by the firm’s leaders and board, individual and group financial and non-financial responsibilities are explicitly recorded as Executive Performance Goals.

At the end of the performance period, each participant determines whether they have earned all or part of their target incentive compensation award based on how actual performance compares to financial and non-financial targets that were approved at the beginning of the period and recommend a corresponding reward. Recommendations are then reviewed and approved by their manager and the Core Leadership Group.

The following provides guidance on how performance goals are set and how the program is managed.

Objectives

It is important to keep in mind the objectives of the Executive Incentive Compensation Program. When in doubt about how to handle a specific situation, refer back to these objectives. In evaluating a participant’s performance, The Core Leadership group will judge any specific situation in light of these objectives:

- Provide Clear Direction: Performance goals are to provide clear communication about what an executive or group is expected to accomplish. Difficulty in setting goals generally reflects indecision or lack of clarity on the part of the executive and his or her unit leader. It is their responsibility to drive the process until clarity and specificity are achieved.

- Provide a Means of Measuring Accomplishments: Clear goals, both financial and non-financial, ensure a way of measuring whether an individual, or a group, has accomplished what it set out to do. For the program to serve this objective, goals must be defined so that their achievement is measurable.

- Provide a Means for Rewarding Accomplishments: If key people meet their goals, the organization as a whole will meet its overall goals and can, therefore, afford to provide additional compensation in the form of individual bonuses. The objective is to reward individuals for accomplishments that contribute to the success of the organization.

The ideal outcome is for everyone in the program to meet his or her own goals and receive the full target amount. While a 100% success rate is unlikely, there is no ceiling or quota on the number of participants who can receive bonus awards by meeting their goals.

The success of a unit influences judgment as to the success of the individuals within that unit. Specifically, for example, it is unlikely that a large percentage of key individuals in a group will be judged to have met their goals if the group as a whole falls far short of its performance targets.

Development of Performance Goals

Annual Performance Goals are effective at the start of the fiscal year. Therefore, Performance Goals for program participants should be in development well in advance of budget approval and considered in effect as of the first day of the fiscal year even though they cannot be finalized until the planning process is completed with the annual budget approved by the board (which will generally occur at a board meeting one or two-months into the fiscal year).

Responsibility for Setting Goals

It is the responsibility of each organization unit leader to see that all key staff in their group have written, signed, and approved performance goals. Some unit leaders may prefer to have their key staff initially draft their own goals, while others may draft the initial goals for their participants themselves. Either method is acceptable, provided that each participant and his or her manager ultimately reach agreement on the written statement of the goals and that those goals are approved by the Core Leadership Group.

While managers have final responsibility for setting goals, each person in the program also has responsibility to be sure that he or she has, understands, agrees with, and is committed to achieving written goals for the year. Participants in this program are the senior staff and are expected to take the initiative to be sure that they have clear goals. A program participant who does not have, does not understand, or does not agree with their goals should take the matter up with their manager or directly with any member of the Core Leadership Group. Likewise, it is vital that every program participant do their part to make sure that key employees in their area have, understand, and agree with what they are signed up to do.

Bonus awards will not be approved for anyone who does not have written, signed, dated, and approved Performance Goals.

Setting Goals that are Measurable

To achieve their purpose, goals (both financial and non-financial) must be measurable. This means they must refer to specific accomplishments, even if judgment is required to determine whether something was accomplished. Quantitative measures, such as revenue, gross margin, project profitability, bookings, growth in backlog, or numbers of hires that have worked out well, retention rates, etc. are especially useful.

In order to make goals measurable:

- Use quantitative measures where possible.

- Keep goals brief and concise, with at most a few items cited.

- When a goal cannot be directly quantified, specify the kinds of data that can be used instead (e.g. delivery dates, client reactions, or deliverable).

It is critical that both financial and non-financial goals be outcome-oriented. The specific purpose of this part of the compensation program is to measure accomplishments that drive organization performance and growth, not personal growth or hard work for its own sake.

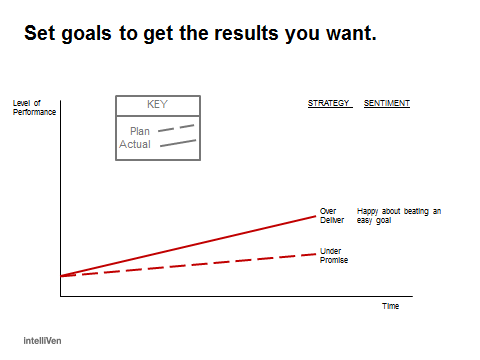

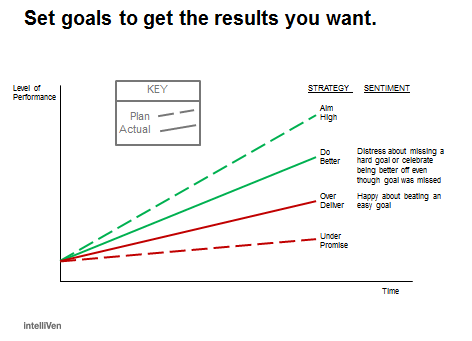

Aggressive but achievable: Both financial and non-financial goals should be aggressive but achievable in light of the individual’s or group’s capabilities, training, and experience and the business circumstances that exist at the time goals are set. Superhuman feats are not expected (although they are certainly welcome!).

External factors partially or completely beyond the person’s or group’s control can result in not meeting goals that were realistic at the time they were set. While it is desirable to set goals that are as controllable as possible, it is impossible to eliminate external factors and external factors do not overwhelm a shortfall in performance to justify an award.

Financial Goals: Client Managers, Project Managers, and Market Leaders have goals that are closely linked to contributing to profits. Managers of indirect activities, such as product development, recruiting, and marketing, have goals tied to producing target results within budget and on time.

Non-Financial Goals: Three to five specific goals to implement key initiatives either within that person’s unit or on an organization-wide basis. Typically, non-financial goals address areas such as recruiting, personnel development, product development, process development, business development, knowledge management, and solution offering development, and specify what an individual or group must do specifically (e.g. hiring four top-notch college graduates, develop two clients with revenue potential greater than $2M per year, develop a delivery strategy for a specific high-stakes prospective client).

Corporate Responsibilities: Certain performance items are a condition of participation in the Executive Incentive Compensation Program without any associated financial incentives. These items include timely and accurate expense reporting, invoicing, time-sheet, and earned revenue submissions; maintaining a current resume and project descriptions; establishment of written professional development plans for self and key unit personnel; on-time submission of plans, budgets, and projections; timely completion of performance assessments, help with proposal preparation and project reviews; and timely submission of salary and promotion recommendations. Sub-optimal performance along any of these lines is grounds for reduced payment of financial incentives or removal from the program altogether.

Handling Changes: Sometimes circumstances during the year change to make some or all of a person’s goals no longer appropriate. This is normal and is not a valid reason for not setting and measuring goals, or for reducing essential management flexibility. The guidelines for handling changes are:

- Anticipate and plan ahead for changes whenever possible.

- Address goals as soon as major changes occur. If a major change in assignments occurs, the area leader responsible for the new assignment sets new goals and asks for an evaluation of the performance against goals up to that point. Just as when goals are set initially, the person whose assignment is changing also has the responsibility to see that this matter is handled properly. The Core Leadership Group finally approves evaluation against goals being closed-out and goals going forward.

- When major changes occur, it is acceptable to sub-divide goals and awards into separate pieces related to each major segment of work under the guidance of the Core Leadership Group which will help determine how best to do so.

Approval of Performance Goals: All performance goals must be reviewed and approved by the Unit Leader and the Core Leadership Group.

Relationship of Goals and Incentive Compensation

Achievement of individual goals is the basis on which individual bonus awards are made for key employees. Achievement of substantially all goals, financial and non-financial, for a year results in the award of the full target amount of the person’s individual bonus, which may be factored by the total bonus pool available. Achieving a major part of, but not all (say, 85%), goals is considered a “near miss” and may result in an award of half the targeted amount, and a failure to achieve a major part of the goals results in no award.

In some cases, it is possible to define achievements in excess of the base goal that are deemed extraordinary performance and may result in an award above the targeted amount. Upside performance levels are set only after base target levels are set and must be financially based.

Continued employment is a condition of award.

Upside Performance Tiers:

- Always work out target performance levels before working on upside scenarios. Once the thinking about upside performance starts it is hard to ever get back to base target if it is not already worked out.

- The downside threshold for half an award (.5 * Award at Target) varies but is never lower than 80% and usually 85-90%. Uninitiated participants may think that if half a goal is achieved then half an award is due. Such thinking must be headed off from the start by making clear that only a near miss qualifies for a fractional award.

- The upside tier varies considerably based on the stage and scale of the unit. An early-stage, small unit might need to hit 150% to hit the 1.5 X tier and a mature, large unit might need only 115% because it is harder to achieve larger percentages at greater scale and under different market circumstances.

- The upside financial metric of performance must be NET of the incremental IC such that upside awards are funded by the results that cause them to be paid.

- Performance tiers are treated as steps and not slopes. That is, a participant needs to accomplish a full tier’s worth of results before earning the next level of award in order to drive performance and avoid complacency, say, halfway through a performance tier.

- Govern the amount paid to a group of people for the same accomplishment so as not to pay out in total more than the organization earns. A governor on group IC upside as a % of the total contribution increment such that the principle is properly applied, as an example, might be as follows, (where ∆ means “change in”; e.g., ∆IC = change in Incentive Compensation):

-

- ∆IC/(∆Contribution + ∆IC) ) <= some reasonable % say 3% (which amounts to essentially a commission rate (or slope of the line) applied to a step function) for each participant; and where

-

- ∑for all participants (∆IC/(∆Contribution + ∆IC) ) <= some reasonable % of the (∆Contribution + ∆IC); say 13%, to ensure that the organization itself sufficiently benefits from the achievement.

Sample Executive Incentive Compensation Participant Goals.