Get Clear. Align. Grow.

We help leaders and their teams architect, build, govern, and change their organizations.

IntelliVen Can Help

Is your top team struggling to transition, expand, or streamline?

Is your organization stuck and not on the growth path you want?

IntelliVen Senior Operating Partners and our Manage to Lead System of Tools, Workstreams, and Tutorials enable you and your leadership team to:

-

- Get Clear about what you seek to accomplish.

-

- Aligned on what needs to be done.

-

- On Track to perform better and grow faster.

Download the IntelliVen Power of Clarity E-book

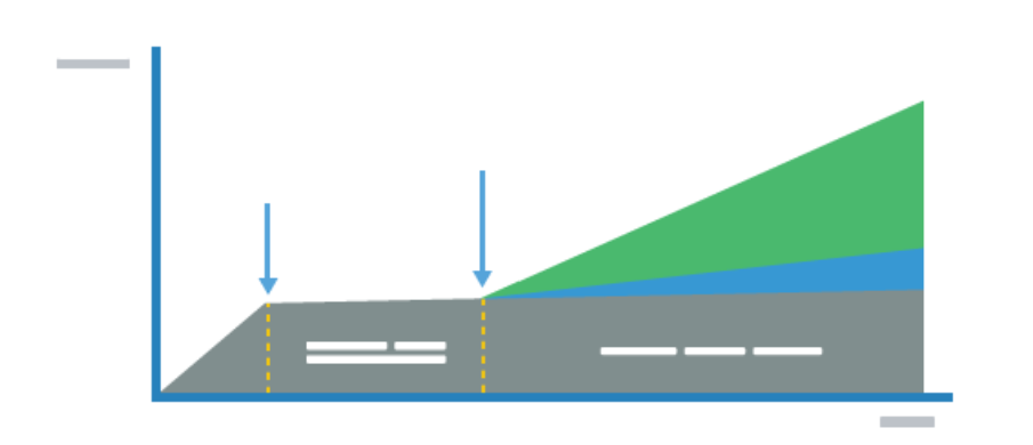

Unrecognized differences in your team's views of your organization's purpose will hamper performance and growth.

Download our e-book for insight into how top-performing organizations fix strategic misalignment.

Clients

Here are some of the organizations we've helped:

Contact Us

We're here to help. Call or email us now for a free consultation.

Join Our Community

Members receive periodic blog posts and access to proprietary tools, insights, and videos.