Business school students have to decide their course of study from day-1 … and the choice makes all the difference. The first decision almost always comes down to operations vs finance:

- The allure of finance is working with money to buy and sell companies. Success is when a small stake in a large transaction generates a healthy payday in a short time.

- The attraction of operations is working with people to build and run something of value that is eventually realized through a sale, financing, or public offering.

Finance looks like the fast track to great wealth and has attracted top MBA students for decades. Operations looks like a long, hard road with a massive payday only for the few with enough dedication, talent, time, and luck to pull off a successful start-up from scratch.

While the economy needs both financiers and operators, the promise of quick and large returns has left the world short of the talent it needs to drive growth of quality organizations.

Top operators get clear about what they seek to accomplish, build and align a team to achieve specific goals, and provide governance and drive over a sustained period to accomplish them. Those who master the art have a high probability of creating wealth for investors, founders, and top teams responsible for the success.

The operations path should be of interest to more top students but it may not be because few understand how it works and where the payoff comes from.

Financiers make multiple bets hoping one will pay off big. Whether one does or does not, the odds of eventual success are good relative to those who start their own ventures and essentially put all their chips on one bet.

A clever and capable operator can improve the odds by throwing in with:

- An early-stage venture that is ready to get past the squirrel-cage of a startup and positioned to grow.

- A going concern that is underperforming relative to its potential (i.e., most organizations!).

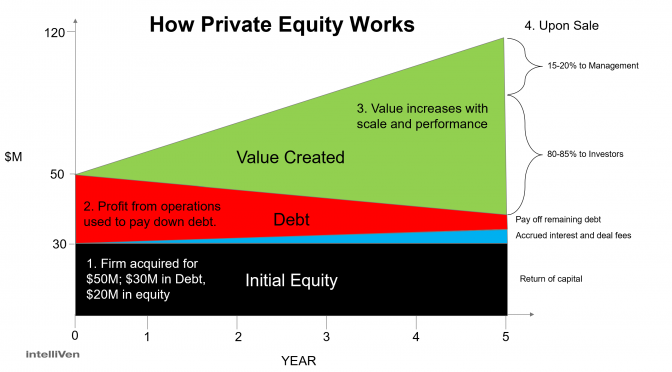

Both courses of study prepare the student to create value in which investors, operating leaders, and their teams participate as summarized in the figure below.

Successful operators take an equity stake in ventures in which they know they can add value and where there does not have to be a grand slam to get a decent payday for those who helped make it happen.

While the payoff is likely not as glamorous or quick, it has higher odds of occurring for operators who know how to build organizations that reliably grow and perform over the long haul.

The best and brightest MBA students should seriously consider operations as a path to help the world, and to help themselves, get on a fast-track to creating value by building, not just financing, organizations, jobs, and people who perform and grow to their full potential.

Related Posts

To get an MBA or to NOT get an MBA…That is the Question!

How CEO’s and Investors can best work together for higher odds of better results sooner.